Green Coverage: Safeguarding Your Cannabis Venture with the Right Insurance

In today’s rapidly evolving cannabis industry, entrepreneurs are navigating a complex landscape filled with both opportunities and challenges. As businesses strive to flourish in this unique market, one crucial aspect often overlooked is the importance of having the right insurance coverage. Given the stigma and legal complications that can surround cannabis ventures, securing dependable and affordable insurance can become a daunting task.

At CARMA365, cannabis insurance isn’t just our business; it’s our passion. We understand the hurdles that cannabis businesses face and are committed to offering tailored and comprehensive insurance solutions specifically designed for the needs of your operation. Our mission centers on safeguarding your venture, ensuring that you can focus on growth and success while we handle the complexities of risk management.

Understanding Cannabis Insurance

Cannabis insurance is a specialized form of coverage designed to meet the unique needs of businesses operating in the cannabis industry. As the cannabis market grows, entrepreneurs face a myriad of risks, from property damage to legal liabilities. Traditional insurance policies often fall short, leaving many businesses vulnerable to unforeseen challenges. At CARMA365, we recognize these complexities and aim to bridge the gap with tailored insurance solutions that cater specifically to the cannabis sector.

In a landscape still facing stigma and evolving regulations, securing reliable insurance coverage can be daunting. Many cannabis businesses encounter difficulties when working with conventional insurance providers who may lack an understanding of the industry’s nuances. This can result in inadequate protection and increased financial exposure. At CARMA365, cannabis insurance isn’t just our business; it’s our passion, and we strive to create a supportive environment for our clients as they navigate these challenges.

Our mission is clear: to provide comprehensive insurance solutions that not only protect cannabis businesses but also foster their growth. Whether it’s general liability, product liability, or coverage for property and equipment, we ensure that our offerings are aligned with the unique requirements of each business. By focusing on the cannabis industry specifically, we are able to offer unmatched expertise and resources that are essential for the success and protection of your venture.

Common Challenges in the Cannabis Industry

The cannabis industry faces a variety of unique challenges that can complicate operations and threaten the sustainability of businesses. One significant hurdle is the ever-evolving legal landscape. With regulations varying widely by state and even within local jurisdictions, cannabis businesses often find themselves navigating a complex web of compliance requirements. This uncertainty can deter investment and make it difficult for companies to establish stable operations.

Another challenge is the stigma associated with cannabis. Despite increasing legalization and acceptance, many insurance providers remain hesitant to engage with cannabis businesses. This reluctance can lead to limited coverage options and inflated premiums, which may not reflect the true risk profile of a well-managed cannabis operation. As a result, businesses may struggle to find adequate insurance that meets their specific needs.

Lastly, the cannabis industry’s inherent risks, including crop insurance and liability concerns, require specialized knowledge that many insurers lack. Traditional insurance models may fail to address the unique aspects of cannabis operations, such as cultivation risks, distribution intricacies, and liability issues related to product use. This gap in understanding can leave businesses exposed and underinsured, underscoring the need for tailored insurance solutions designed specifically for the cannabis sector.

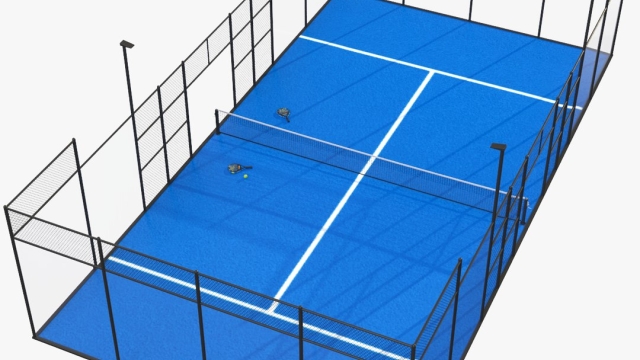

Cannabis Insurance

Tailored Insurance Solutions

At CARMA365, we recognize that the cannabis industry is unique. The legal landscape, combined with the specific challenges that cannabis businesses face, requires insurance solutions that are not one-size-fits-all. Our experts work closely with clients to understand their specific needs and craft insurance policies that provide the right coverage for their operations. Whether you are a cultivator, retailer, or manufacturer, we ensure that your coverage addresses the distinct risks associated with your business.

Our tailored solutions encompass a wide range of coverage types, including general liability, product liability, crop insurance, and property coverage. Each aspect is designed to protect your assets and investments from unforeseen circumstances, such as theft, natural disasters, or changes in legislation. By choosing a policy custom-fitted to your operations, you can mitigate risks and focus on what you do best—running your cannabis venture.

Moreover, we pride ourselves on our responsive customer service, guiding clients through the complex world of cannabis insurance. Our team stays updated on industry changes and legal developments to provide clients with proactive advice and adjustments to their coverage when necessary. With CARMA365, you can be assured that you have a partner dedicated to safeguarding your business and supports your growth and success in a challenging market.

Importance of Compliance and Risk Management

In the cannabis industry, compliance and risk management are essential to maintaining a successful operation. The legal landscape surrounding cannabis can be complex and ever-changing, which makes it crucial for businesses to stay informed about local, state, and federal regulations. Non-compliance can lead to severe penalties, including fines and the potential loss of licenses. By prioritizing compliance, cannabis businesses can protect themselves from legal repercussions and establish a solid foundation for growth.

Effective risk management is equally important in safeguarding your cannabis venture. The unique challenges of this industry, such as theft, crop failure, and liability issues, can pose significant threats to business viability. By identifying potential risks and implementing strategies to mitigate them, companies can not only secure their assets but also instill confidence in customers and investors. Having a robust risk management plan in place can reduce the likelihood of unexpected setbacks that might jeopardize the business’s future.

At CARMA365, we recognize that tailored insurance solutions can play a vital role in both compliance and risk management. Our mission is to provide cannabis businesses with the peace of mind that comes from knowing they have comprehensive coverage that addresses the specific risks they face. With the right insurance in place, businesses can focus on their passion for cannabis, confident that they are protected from the uncertainties of this dynamic industry.