Unlocking the Secrets of Real Estate Investment: A Beginner’s Guide

Welcome to the world of real estate investment, where opportunities abound for those looking to delve into the realm of property ownership and financial growth. Real estate has long been a favored avenue for individuals seeking to build wealth over time, offering a tangible and reliable asset that can yield substantial returns. Whether you’re a first-time investor or someone looking to expand your existing portfolio, understanding the intricacies of real estate investing is key to navigating this dynamic market successfully.

Benefits of Real Estate Investment

Investing in Real Estate offers a tangible asset that can generate passive income through rental payments. Unlike some investments that may fluctuate in value, Real Estate typically appreciates over time, increasing the potential for long-term wealth growth. This steady appreciation can provide a sense of security and stability to investors looking to build a solid financial foundation.

Another benefit of Real Estate Investment is the opportunity to leverage the investment by utilizing financing options. By using borrowed funds to purchase properties, investors can increase their buying power and potential returns. This strategy allows individuals to control a larger asset with a smaller initial investment, maximizing their potential profitability.

Moreover, Real Estate Investment provides tax advantages that can help reduce the overall tax burden for investors. Tax deductions on mortgage interest, property taxes, depreciation, and other expenses can significantly lower taxable income, increasing the overall return on investment. Additionally, long-term Real Estate holdings qualify for capital gains tax rates, offering potential tax savings on profits from property sales.

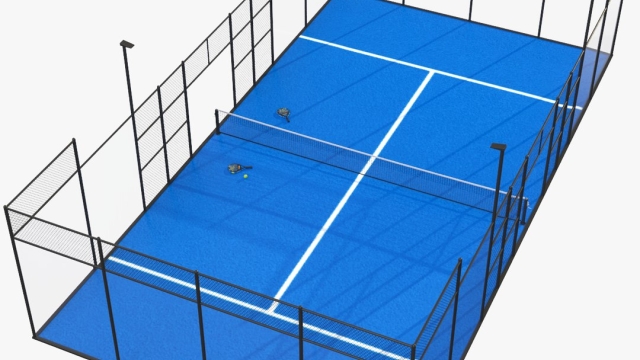

Types of Real Estate Investments

When it comes to real estate investments, there are several avenues that beginners can explore. One common type is residential real estate, which involves purchasing properties for individuals and families to live in. This can include single-family homes, apartments, and condominiums.

Belize Real Estate

Another popular option is commercial real estate, which involves properties used for business purposes. This can include office buildings, retail spaces, and warehouses. Investing in commercial real estate can provide stable income streams and potential for long-term appreciation.

Lastly, there is the option of investing in real estate investment trusts (REITs). REITs are companies that own, operate, or finance income-producing real estate across a range of sectors. Investing in REITs can provide diversification and the opportunity to earn passive income without directly owning physical properties.

Tips for Successful Real Estate Investing

First and foremost, it is crucial for beginners in real estate investing to conduct thorough research. Understanding market trends, local regulations, and property values will provide a firm foundation for making informed investment decisions.

Networking with other real estate professionals can be a valuable asset in the journey towards successful investing. Building relationships with real estate agents, contractors, and experienced investors can provide guidance, resources, and potential investment opportunities.

Lastly, it is important for beginners to start small and gradually expand their investment portfolio. Begin with a single property to gain experience and confidence before taking on larger projects. This gradual approach can help minimize risks and maximize returns over time.