Mastering the Art of Bookkeeping: A Practical Guide for Small Businesses

Welcome to our practical guide on mastering the art of bookkeeping for small businesses. Bookkeeping forms the foundation of any successful business, providing a clear snapshot of financial health and facilitating important decision-making processes. Whether you are a sole proprietor just starting out or a small business looking to streamline your accounting practices, understanding the ins and outs of bookkeeping is essential for sustainable growth and long-term success.

Bookkeeping involves the systematic recording, organizing, and tracking of financial transactions within a business. It is a meticulous process that requires attention to detail and accuracy to ensure the financial data is reliable and meaningful. By establishing solid bookkeeping practices early on, small businesses can not only fulfill regulatory requirements but also gain valuable insights into their operations, cash flow, and profitability.

The Basics of Bookkeeping

Bookkeeping is the process of recording financial transactions in an organized manner. It involves keeping track of income, expenses, and other monetary transactions to maintain accurate financial records.

Good bookkeeping practices are essential for small businesses as they provide valuable insights into the financial health of the company. By regularly updating and reviewing financial records, businesses can make informed decisions and streamline their operations.

Whether using software or traditional pen and paper methods, establishing a consistent bookkeeping system is crucial for small businesses to track cash flow, monitor expenses, and prepare financial reports.

Implementing Bookkeeping Systems

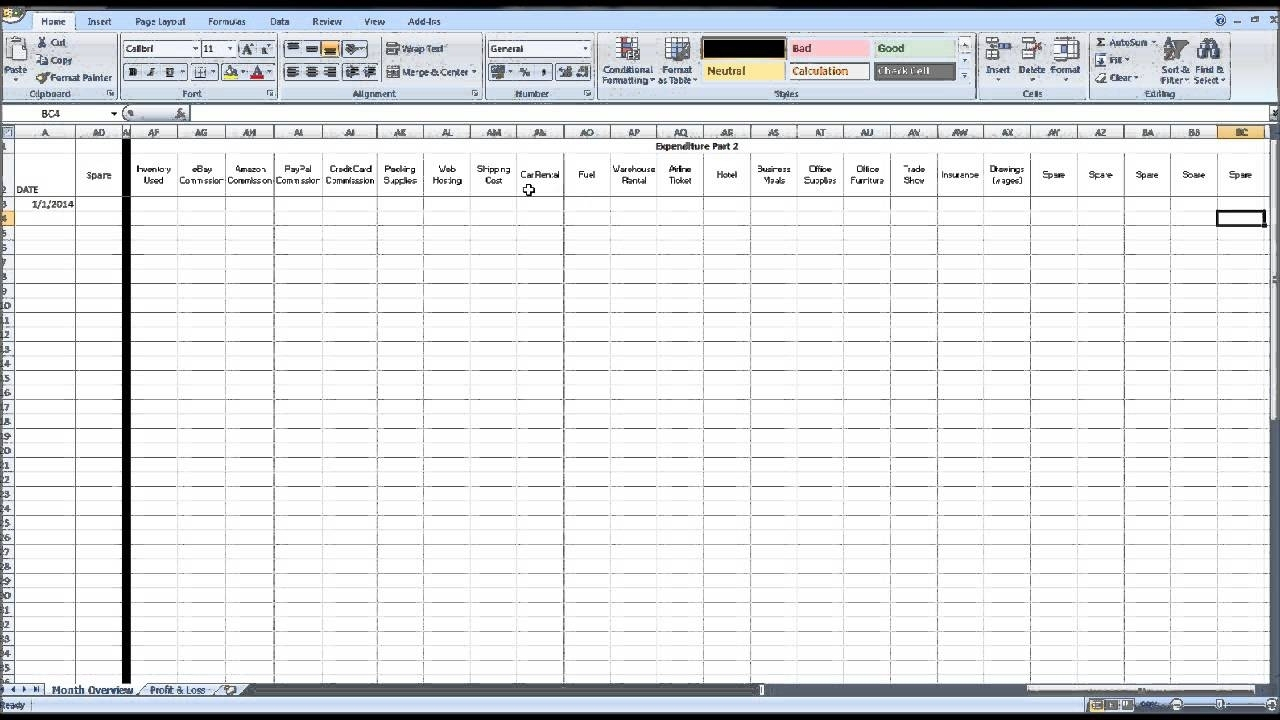

Firstly, when implementing bookkeeping systems for your small business, it is crucial to choose the right software that aligns with your specific needs. Look for user-friendly platforms that offer features such as automatic bank feeds, customizable reporting, and data backup capabilities.

Secondly, establish a clear and organized chart of accounts to categorize your income, expenses, assets, and liabilities effectively. This will streamline the bookkeeping process and make it easier to track your financial transactions accurately.

Lastly, ensure regular monitoring and reconciliation of your accounts to maintain accuracy and detect any discrepancies promptly. By staying on top of your bookkeeping tasks consistently, you can make informed business decisions and keep your finances in order.

Bookkeeping Services

Bookkeeping Best Practices

In order to excel at bookkeeping for your small business, there are several best practices that can help streamline your financial management. Firstly, it is essential to maintain separate business and personal accounts to avoid commingling funds. This practice not only simplifies tracking business expenses but also makes tax preparation much more straightforward.

Another crucial practice is to keep meticulous records of all transactions, including invoices, receipts, and bank statements. Implementing a digital bookkeeping system can greatly aid in organizing and categorizing these documents efficiently. Regularly reconciling accounts and reviewing financial reports will provide valuable insights into the financial health of your business.

Lastly, staying organized and disciplined with your bookkeeping tasks is key to success. Setting aside dedicated time each week to update records, reconcile accounts, and analyze financial data can prevent errors and ensure that your business is on solid financial footing. By following these best practices consistently, you can master the art of bookkeeping and effectively manage your small business finances.