The Future of Finance: Exploring the Revolutionary Potential of Web3 and DeFi

Web3 and Decentralized Finance (DeFi) are driving a revolutionary wave in the world of finance. With advancements in blockchain technology and the rise of cryptocurrencies, these concepts are reshaping traditional financial systems and decentralizing control. In this article, we will explore the potential of Web3 and DeFi, delving into how they can transform our understanding of finance and provide new opportunities for individuals worldwide.

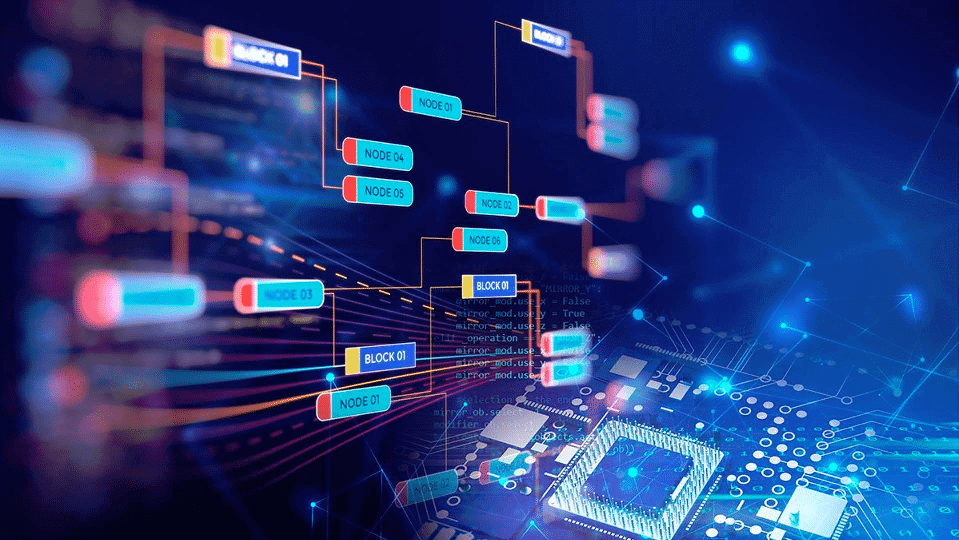

At its core, Web3 encompasses the next generation of the internet, where users have greater control over their data and interactions. It is built on the principles of openness, transparency, and decentralization, aiming to empower individuals by removing intermediaries and enabling peer-to-peer transactions. By leveraging blockchain technology, Web3 allows for trustless interactions, where smart contracts and decentralized applications (DApps) ensure the execution of agreements and transactions without a centralized authority.

DeFi, on the other hand, refers to the movement that brings traditional financial services onto the blockchain, making them accessible to anyone with an internet connection. By leveraging blockchain’s immutability and transparency, DeFi offers a wide range of financial services such as lending, borrowing, trading, and asset management without the need for intermediaries like banks or brokerage firms. These services are executed through smart contracts and powered by cryptocurrencies, providing users with more control over their assets and eliminating traditional barriers to entry.

The combination of Web3 and DeFi holds immense potential for transforming financial systems globally. Traditional finance is often plagued by high fees, slow transaction times, and limited accessibility, especially for underprivileged communities. However, with Web3 and DeFi, financial services become more affordable, efficient, and accessible to individuals globally. Smart contracts ensure the automatic execution of agreements, reducing the need for intermediaries and associated fees. Moreover, the decentralized nature of these systems makes them less prone to censorship and manipulation, instilling trust and security within the ecosystem.

As we delve deeper into the world of Web3 and DeFi, we will explore the various applications of these technologies, their benefits, challenges, and potential risks. We will also discuss the role of cryptocurrencies in the ecosystem and how they facilitate borderless transactions and financial inclusivity. Join us on this journey as we uncover the revolutionary potential of Web3 and DeFi, and the impact they may have on the future of finance.

Web3: Redefining the Financial Landscape

In recent years, the emergence of Web3 technologies has brought about a significant shift in the financial landscape. Web3, which encompasses decentralized finance (DeFi) applications built on blockchain technology, is revolutionizing the way we think about and interact with traditional financial systems.

At the heart of Web3 is the decentralized nature of its infrastructure. Unlike traditional financial systems that rely on intermediaries such as banks, Web3 utilizes blockchain technology to create a trustless and transparent environment. This decentralization has the potential to eliminate the need for middlemen, lower transaction costs, and increase accessibility to financial services for individuals across the globe.

One of the key components of Web3 is DeFi, which refers to the use of blockchain technology and cryptocurrencies to recreate traditional financial services in a decentralized manner. With DeFi, individuals can access a range of financial products and services, such as lending, borrowing, and trading, without the need for intermediaries. This not only reduces costs but also opens up opportunities for financial inclusion for individuals who were previously excluded from traditional financial systems.

Blockchain technology, a fundamental pillar of Web3, plays a crucial role in ensuring the security and immutability of financial transactions. Its decentralized nature eliminates the risk of a single point of failure and makes it virtually impossible to tamper with or manipulate data. This level of security and transparency has not only gained the trust of users but has also attracted the interest of financial institutions and governments seeking to leverage the potential of Web3 and DeFi.

The intersection of Web3, DeFi, blockchain, and cryptocurrency presents a paradigm shift in the way we perceive and engage with finance. As this technology continues to evolve, we can expect to see further advancements that challenge traditional financial systems, decentralize power, and empower individuals to take control of their financial future. The future of finance lies in the hands of Web3 and DeFi, and it is both exciting and full of promise.

Unleashing the Power of DeFi

In the world of finance, a new paradigm is emerging known as Decentralised Finance (DeFi). This revolutionary concept is redefining the way we think about traditional banking and has the potential to change the face of the financial industry as we know it.

At the heart of DeFi lies the power of Web3, a decentralized version of the internet that operates on blockchain technology. Unlike the centralized systems of traditional finance, Web3 introduces a new level of transparency, security, and efficiency. By leveraging blockchain’s immutable and distributed ledger, DeFi projects are able to provide financial services and products without the need for intermediaries.

With the rise of DeFi, individuals across the globe now have access to a wide range of financial services that were previously limited to a select few. From lending and borrowing to trading and investing, the possibilities are endless. Through smart contracts, transactions can be executed automatically, removing the need for trust in traditional financial institutions.

Furthermore, DeFi platforms create a level playing field by removing barriers to entry and enabling financial inclusion for the unbanked or underbanked populations. No longer do individuals need to rely on traditional banking infrastructure or meet stringent criteria to access financial services. With just a smartphone and an internet connection, anyone can participate in this new era of decentralized finance.

The future of finance is unfolding before our eyes, and the potential of Web3 and DeFi is truly awe-inspiring. As more projects enter the market and new innovations arise, the traditional financial system as we know it will continue to be disrupted. The power of decentralization, blockchain technology, and cryptocurrency is reshaping the way we interact with money, making financial services more accessible, efficient, and inclusive than ever before. Get ready to embrace the future, because the possibilities of Web3 and DeFi are only just beginning to be explored.

Navigating the Promise and Challenges of Blockchain and Cryptocurrency

In the world of finance, blockchain and cryptocurrency have emerged as promising technologies that hold the potential to revolutionize the way we transact and manage digital assets. However, they also bring along their fair share of challenges that must be navigated.

Kaddex Subtraqt

First and foremost, blockchain technology, which underpins cryptocurrencies, offers an unprecedented level of transparency and security. By utilizing a decentralized network of computers, transactions can be recorded immutably, ensuring a high level of integrity. This lends itself to a multitude of applications beyond just financial transactions, such as supply chain management, voting systems, and even identity verification.

Yet, with the promise of blockchain, there come challenges. One of the key hurdles is scalability. Current blockchain networks face limitations in terms of transaction speed and capacity, which need to be addressed for widespread adoption. Solutions such as layer-two scaling and sharding are being explored, but further research and development are required to achieve seamless scalability.

Moreover, the regulatory landscape surrounding cryptocurrencies remains uncertain and differs across jurisdictions. Governments and regulatory bodies are still grappling with how to approach and regulate this new asset class. Striking a balance between protecting consumers and fostering innovation will be crucial to ensure the long-term success of cryptocurrencies and blockchain technology.

In conclusion, the rise of blockchain technology and cryptocurrencies brings both immense promise and significant challenges. While the potential benefits in terms of transparency, security, and efficiency are undeniable, addressing scalability issues and establishing clear regulatory frameworks are vital steps for the future of finance. By navigating these hurdles, we can unlock the full revolutionary potential of Web3 and decentralized finance (DeFi).