The Hidden Benefits of Captive Insurance: Unlocking Your Company’s Financial Potential

In the complex world of business, insurance plays a crucial role in protecting companies from unexpected financial risks. While traditional insurance options have long been relied upon, a lesser-known yet highly beneficial alternative exists: captive insurance. Captive insurance refers to the formation of an insurance company by a parent company to cover its risks, thereby allowing for greater control, cost savings, and potential financial gain.

One valuable aspect of captive insurance lies in its utilization of the 831(b) tax code. This specific section of the IRS tax code enables small and mid-sized businesses to take advantage of certain tax benefits when establishing captive insurance companies. By meeting the requirements outlined in this code, companies can access tax advantages that can significantly impact their financial bottom line.

Furthermore, microcaptives, a subset of captive insurance, offer even more advantages for qualifying businesses. These specialized captives allow companies to insure risks that may be excluded or too costly to cover under traditional insurance policies. With microcaptives, businesses can tailor their insurance coverage to suit their unique needs while enjoying the potential for significant cost savings.

By unlocking the hidden benefits of captive insurance, companies can experience heightened financial potential and be equipped with a powerful risk management tool. Whether it’s through the utilization of the 831(b) tax code or the flexibility offered by microcaptives, captive insurance opens up a world of possibilities for businesses seeking to optimize their insurance coverage and bolster their financial well-being.

1. Understanding Captive Insurance and its Benefits

Captive insurance, also known as 831b insurance, refers to a specialized form of self-insurance that allows companies to take control of their risk management strategies. It operates under the provisions of the IRS 831(b) tax code, which provides certain tax advantages for qualifying microcaptives.

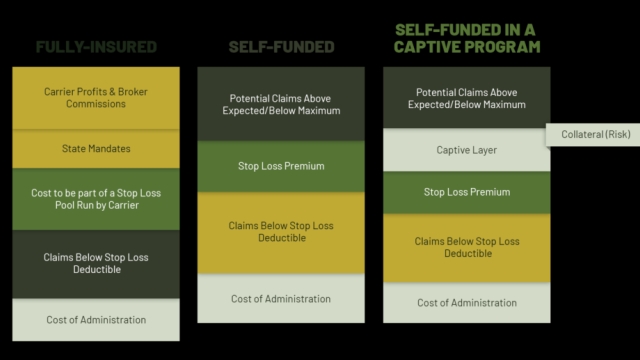

By establishing a captive insurance company, businesses can retain risk within their organization rather than relying solely on traditional commercial insurance policies. This approach offers several notable benefits.

Firstly, captive insurance provides greater flexibility and customization in coverage options. Unlike off-the-shelf insurance policies, captives can be tailored to meet the specific needs and risks faced by a particular business. This allows companies to design comprehensive coverage plans that address their unique exposures and assets.

Secondly, captive insurance enables businesses to gain better control over their insurance costs. Traditional insurance premiums are based on industry-wide risk assessments, which may not accurately reflect the actual risk profile of an individual company. By retaining risk internally, businesses can align insurance costs with their own risk management efforts and claims experience, potentially saving significant amounts of money in the long run.

Lastly, captive insurance offers tax advantages through the IRS 831(b) tax code. Under this provision, qualifying microcaptives can elect to be taxed only on their investment income, rather than their underwriting profits. This can result in substantial tax savings for companies, allowing them to reinvest these funds into their core operations or further enhance their risk management strategies.

In conclusion, captive insurance provides companies with the opportunity to unlock their financial potential by taking control of their risk management strategies. With increased flexibility, cost savings, and tax benefits, captives offer a compelling alternative to traditional commercial insurance policies. By understanding and leveraging the benefits of captive insurance, businesses can effectively protect their assets and optimize their financial performance.

2. Leveraging the IRS 831(b) Tax Code for Financial Advantage

Captive insurance, also known as microcaptive insurance, presents numerous financial opportunities for companies. One key advantage is the utilization of the IRS 831(b) tax code. This section of the tax code has proven to be a valuable tool for businesses seeking to optimize their financial strategies.

Under the IRS 831(b) tax code, small or mid-sized companies can form their own captive insurance companies as a means to manage their risks. By setting up a captive insurance entity, businesses gain the ability to insure their own risks instead of relying solely on traditional insurance providers. This greater control allows companies to tailor insurance coverage to their specific needs, potentially reducing overall insurance costs.

Additionally, companies that qualify under the IRS 831(b) tax code benefit from favorable tax treatment. Premiums received by the captive insurance company may be tax-exempt up to a certain limit, providing a potential tax advantage for businesses. This tax efficiency allows companies to allocate more of their resources towards strategic growth initiatives or other areas of their operations.

Furthermore, captive insurance creates an opportunity for companies to build their own reserves. As captive insurance entities are typically created to address specific risks faced by the company, they can accumulate retained earnings over time to strengthen their financial position. This reserve fund can be tapped into during times of unforeseen losses or used for future strategic investments, providing additional financial security and flexibility for the company.

In summary, leveraging the IRS 831(b) tax code empowers companies to establish captive insurance entities and benefit from greater risk management control, potential tax exemptions, and the ability to build reserves. These advantages enable businesses to unlock their financial potential and optimize their overall financial strategies.

3. Maximizing Company Growth Through Microcaptives

A captive insurance company, particularly a microcaptive operating under IRS 831(b) tax code, can provide significant financial benefits for your business. By understanding how to leverage the advantages of captive insurance, your company can unlock its full potential and experience accelerated growth.

Captive Insurance

Firstly, a microcaptive insurance arrangement allows your company to take control of its own risks and liabilities. Instead of relying solely on traditional insurance policies, a microcaptive enables you to create a tailored insurance program that aligns precisely with your business needs. This level of customization ensures that potential risks specific to your industry or operations are adequately covered, providing a strong foundation for sustainable growth.

Additionally, utilizing a microcaptive can lead to substantial cost savings for your company. Traditional insurance policies often come with premiums that may not be commensurate with your business’s actual risk exposure. By establishing a microcaptive, you have the ability to retain a portion of the risk through your captive, leading to reduced insurance costs over time. This cost-saving strategy frees up capital that can be reinvested back into your business, fueling expansion and innovation.

Furthermore, a microcaptive can offer tax advantages that can significantly impact your company’s bottom line. Under the IRS 831(b) tax code, premiums received by a microcaptive up to a certain threshold are exempt from federal income tax. This tax-efficient structure allows your business to accumulate wealth within the captive, providing additional funds for future growth or investment opportunities. By taking advantage of these tax benefits, you can maximize your company’s financial potential and create a solid foundation for long-term success.

In conclusion, embracing a microcaptive insurance arrangement presents a valuable opportunity for companies looking to boost their growth and financial stability. By customizing insurance coverage, reducing costs, and leveraging tax advantages, your business can unlock hidden benefits and position itself for accelerated expansion. Consider exploring the potential of captive insurance to unlock your company’s full financial potential and drive long-term success.