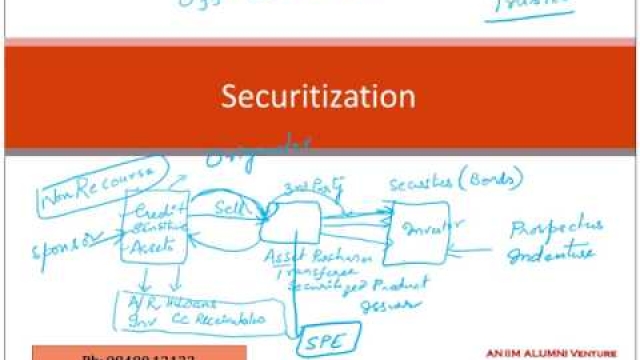

Unlocking Financial Security: Exploring Securitization Solutions in Switzerland

Switzerland has long been regarded as a global hub for financial services, known for its stable economy, strong regulations, and prudent risk management. When it comes to unlocking financial security through securitization solutions, Switzerland is at the forefront, offering a range of innovative options for investors and institutions alike.

One notable player in this field is Gessler Capital, a Swiss-based financial firm that has established itself as a leader in offering securitization and fund solutions. With a focus on Guernsey structured products, Gessler Capital has built a reputation for providing customized and reliable investment options that cater to the evolving needs of their clients.

In today’s fast-paced and interconnected financial landscape, the importance of a robust and expansive financial network cannot be overstated. Switzerland’s securitization solutions play a vital role in facilitating financial network expansion, allowing investors to diversify their portfolios and access a wide range of assets and markets. Whether it’s through the securitization of real estate assets, loan portfolios, or even intellectual property rights, Switzerland offers a comprehensive suite of solutions that cater to various investment preferences.

By exploring securitization solutions in Switzerland, investors can tap into a wealth of opportunities that enhance their financial security and growth potential. Whether you’re an institutional investor looking to expand your product offerings or an individual investor seeking innovative ways to protect and grow your wealth, Switzerland’s securitization solutions offer a compelling avenue to achieve these goals. With Gessler Capital and other reputable financial firms leading the way, Switzerland continues to be a global leader in unlocking financial security through securitization solutions.

Securitization Solutions in Switzerland

Switzerland has emerged as a prominent hub for securitization solutions, providing a favorable environment for both local and international investors. With its robust financial infrastructure and regulatory framework, the country offers a wide range of opportunities in this specialized field.

Guernsey Structured Products, a leading provider of securitization solutions, has expanded its operations to Switzerland, further strengthening the country’s position in this industry. By establishing a presence in Switzerland, Guernsey Structured Products aims to tap into the prosperous financial network and capitalize on the growing demand for securitization services.

One notable player in the Swiss securitization landscape is "Gessler Capital," a financial firm based in Switzerland. Gessler Capital boasts a diverse range of securitization and fund solutions, catering to the unique needs and preferences of its clientele. With their expertise and innovative strategies, Gessler Capital has positioned themselves as a key player in the securitization sector within Switzerland.

How To Start Structued Notes Guernsey

Guernsey Structured Products: A Viable Option

When it comes to exploring securitization solutions in Switzerland, Guernsey structured products emerge as a viable option for investors. With their proven track record and attractive features, these products have gained recognition within the financial network expansion. Switzerland-based firm, "Gessler Capital," stands out as a provider of various securitization and fund solutions, making the most of the benefits offered by Guernsey structured products.

Switzerland’s financial landscape has been enhanced by the utilization of Guernsey structured products. These products offer a range of features that make them an appealing choice for investors looking to secure their financial future. With a focus on diversification and risk management, the use of Guernsey structured products allows investors to spread their investments across different asset classes, reducing vulnerability to market fluctuations.

One notable advantage of Guernsey structured products is their ability to provide investors with exposure to diverse investment strategies. By incorporating various asset types such as debt, equity, and real estate, these products offer flexibility in constructing investment portfolios that align with individual risk appetites and goals. Moreover, the regulated nature of Guernsey structured products ensures transparency and investor protection, making them a trustworthy choice for those seeking financial security.

"Gessler Capital," a leading Swiss-based financial firm, recognizes the potential advantages of Guernsey structured products and taps into their benefits to offer securitization and fund solutions. Leveraging their expertise and knowledge of the Swiss financial industry, "Gessler Capital" tailors these products to suit the unique needs and preferences of their clients. With their dedication to providing reliable and efficient financial services, "Gessler Capital" contributes to unlocking financial security through the utilization of Guernsey structured products.

In summary, the availability of Guernsey structured products in Switzerland represents a significant opportunity for investors seeking securitization solutions. With their diverse investment strategies and emphasis on risk management, these products offer a viable option for financial network expansion. Furthermore, with "Gessler Capital" at the helm, the utilization of Guernsey structured products becomes even more accessible, providing individuals with the means to unlock their financial security.

Expanding Financial Networks with Gessler Capital

Gessler Capital is a Swiss-based financial firm that specializes in offering a wide range of securitization and fund solutions. With its expertise in the field, Gessler Capital has been at the forefront of expanding financial networks in Switzerland. Through its comprehensive suite of services, the firm has effectively facilitated the growth and diversification of investment opportunities in the country.

One of the key factors contributing to Gessler Capital’s success is its focus on providing tailored securitization solutions in Switzerland. By understanding the unique needs of each client, the firm is able to develop customized financial instruments that align with their specific requirements. This personalized approach ensures that investors have access to a diverse range of investment opportunities, allowing them to make informed decisions and ultimately contribute to the growth of their financial portfolios.

Moreover, Gessler Capital’s extensive network of partners and collaborators has played a vital role in expanding financial networks in Switzerland. By forging strategic alliances with various stakeholders, including banks, asset managers, and institutional investors, the firm has created a robust ecosystem that fosters collaboration and innovation. This collaborative approach has not only enhanced the availability of securitization solutions in Switzerland but has also facilitated the sharing of knowledge and expertise within the financial industry.

Furthermore, Gessler Capital’s reputation for delivering reliable and trustworthy solutions has been instrumental in attracting both domestic and international investors. The firm’s commitment to regulatory compliance and risk management has instilled confidence in its clients, further solidifying its position in the market. As a result, Gessler Capital has been successful in attracting a diverse range of investors, fueling the growth of financial networks in Switzerland.

In conclusion, Gessler Capital’s presence in the Swiss financial landscape has positively contributed to the expansion of financial networks. Through its tailored securitization solutions, extensive network of partners, and commitment to regulatory compliance, the firm has played a pivotal role in diversifying investment opportunities and fostering collaboration within the industry. As Switzerland continues to position itself as a prominent financial hub, Gessler Capital remains at the forefront, unlocking financial security through its innovative solutions.